salt tax cap removal

This would reduce federal revenue by about 135 billion between 2022 and 2025. A two-year SALT cap repeal.

What S The Deal With The State And Local Tax Deduction Publications National Taxpayers Union

Democrats reportedly are considering a plan to repeal the 2017 cap on the state and local tax SALT deduction for 2022 and 2023 only.

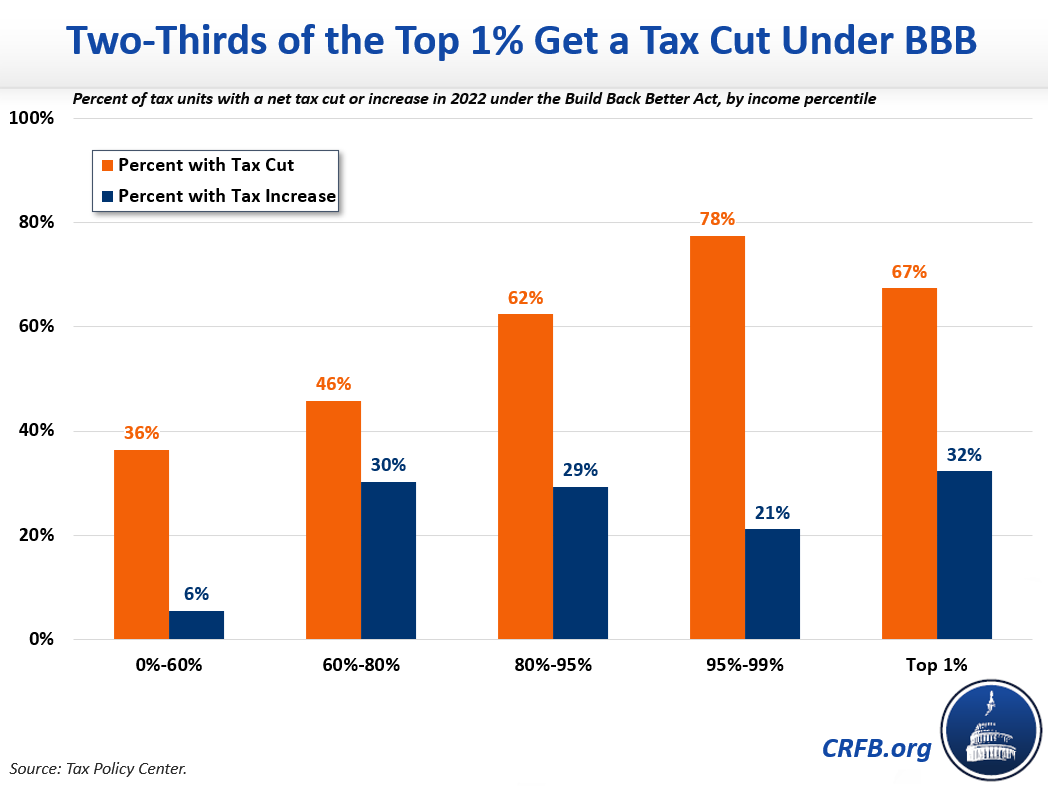

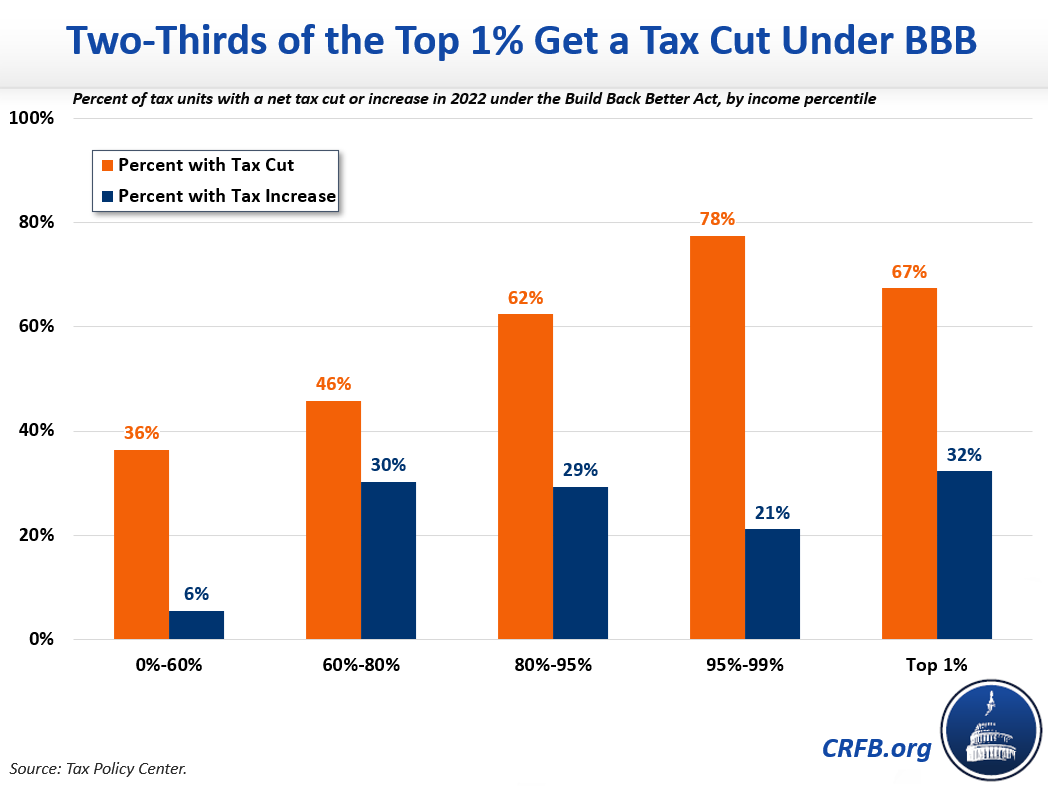

. The governors on Friday argued For the first time since Abraham Lincoln created the federal income tax the cap on SALT deductions established a system of double taxation where 11 million. The legislation would double the SALT deduction cap to 20000 for joint filers for 2019 and fully restore the deduction for 2020 and 2021. Almost all 96 percent of the benefits of SALT cap repeal would go to the top quintile giving an average tax cut.

Democrats plan to undo President Donald Trumps 10000 cap on the state and local tax deduction is likely to end up enshrining looser restrictions on the. In 2021 Joe Trader pays 35000 of state income taxes on the S-Corp level using a SALT cap workaround. As alternatives to a full repeal of the cap lawmakers and experts have proposed a number of changes to the SALT deduction.

Phil Murphy today reaffirmed his strong support for lifting the cap but didnt sound willing to scrap the reconciliation bill over the issue. Enacted by the Tax. One of the most important reforms in the 2017 tax reform legislation was the 10000 cap on the deductibility of state and local taxes SALT such as property taxes and sales taxes.

Doubling the cap to 20000 would remove the marriage penalty but it would reduce federal revenue by about 75 billion between 2022 and 2025. A group of Blue State Democrats has insisted on some SALT fix as their price for supporting Bidens Build Back Better plan. However high-tax states imposed tremendous pressure on Congress.

Democrats have forged a compromise to partially lift the so-called SALT tax deduction cap that hit the New York metro area particularly hard. Another proposal would increase the SALT cap to 15000 for single filers and 30000 for joint filers. As Congress wrestles over changes to the 10000 cap on the federal deduction for state and local taxes known as SALT many business owners already qualify for a workaround.

Salt tax cap removal Tuesday April 19 2022 Edit. For example policymakers have proposed doubling the cap for married couples or making it more generous. The states 2018 analysis showed 752000 Californians earning less than 250000 a year paid an additional 1 billion in federal taxes.

To allow unlimited deductions just in 2021 would cost 88. Even those making between 17500 and 250000 would get a tax cut of just over 400 or about 02 percent of after-tax income. But it faces an uphill battle in the Senate.

The thinking is if filers cant deduct the state and local taxes they pay in excess of 10000 on their federal returns states like New York. The latest SALT plan would remove the current 10000 cap part of the 2017 tax overhaul entirely for those making less than 400000 a year. For tax year 2019 it.

Even a temporary repeal would be costly and. By contrast the higher SALT cap would boost after-tax incomes by 12. The tax law passed in 2017 placed a cap on the SALT deduction at 10000 in an attempt to offset the tax cuts included in the legislation.

We need the SALT cap lifted period. Heres an example. Taxpayers can deduct up to 10000 of the state and local.

Senate Democrats Flickr. Its the single biggest tax. At a news conference last month Pelosi called the limit devastating and said she wants to remove the cap which prevents taxpayers from deducting more than 10000 of state and local taxes.

A host of moderate Democrats say they wont support President Joe Bidens 35 trillion package without a repeal of the cap on state and. A drive led by some US. Lawmakers from high-tax states gained steam on Thursday as they launched a bipartisan SALT caucus The new 30-member group seeks a repeal of the 10000 cap on.

Democratic Senate majority leader Chuck Schumer has been pushing the proposal to remove the SALT deduction cap. House Speaker Nancy Pelosi signaled support for a move to put a repeal of the 10000 cap on state and local tax deductions in the infrastructure and social-spending program that Democrats are. His S-Corp net income is 500000 subject to a state tax rate of 7.

The state and local tax deduction cap commonly known as SALT was enacted as part of President Donald Trumps 2017 tax reforms. Repealing the SALT cap is a costly proposition and Democrats have a firm 19 trillion limit for the pandemic relief bills total cost. Between 2022 and 2025 the cost of repealing the cap would be 380 billion according to the Tax Foundation.

The legislation would remove the 10000 cap on state and local tax deductions for tax years 2020 and 2021. November 11 2021 1100 PM PST. Multiple Republican members of the House from high-tax states like New York New Jersey and California voted against the bill because of this measure.

The House controlled by Democrats voted largely along party lines to remove the 10000 cap on state and local tax SALT deductions for tax years 2020 and 2021. Limiting the deductibility of such taxes has long been a priority of center-right tax reformers. The deal which was included in President Bidens.

The rich especially the very rich. Responding to reports from yesterday that the State and Local Tax SALT deduction cap lift may be removed from President Joe Bidens Build Back Better plan Gov. The remaining four percent of the benefit of removing the cap would go the middle class ie.

Features Freshbooks Feature Used Tools

Tpc Analyzes Five Ways To Replace The Salt Deduction Cap Tax Policy Center

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

Repealing Salt Caps Would Cost Another 500 Billion Committee For A Responsible Federal Budget

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

House Democrats Pass Package With 80 000 Salt Cap Through 2030

Two Thirds Of The One Percent Get A Tax Cut Under Build Back Better Due To Salt Relief Committee For A Responsible Federal Budget

The Salt Deduction The Second Biggest Item In Democrats Budget That Gives Billions To Rich The Washington Post

Cute Waterproof Shower Cap Shower Hat Bathroom Accessories Bathroom Set Z319 Ym Shower Bath Shower Cap Bathroom Sets

5 Year Salt Cap Repeal Would Be Costliest Part Of Build Back Better Committee For A Responsible Federal Budget

By Backing A Huge Tax Giveaway To The Rich Democrats Are Giving The Gop A Perfect Midterm Gift

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

Dems Don T Repeal The Salt Cap Do This Instead Itep

Tpc Analyzes Five Ways To Replace The Salt Deduction Cap Tax Policy Center

What S The Deal With The State And Local Tax Deduction Publications National Taxpayers Union

Repealing The Salt Cap Should Not Be A Top Priority In Reforming 2017 Tax Law Center For American Progress

Calls To End Salt Deduction Cap Threaten Passage Of Biden S Tax Plan